Cosmetic surgery is considered elective surgery, so insurance usually does not cover these operations.

To pay for procedures like laser hair removal, Botox, breast augmentation, or rhinoplasty, patients may have to pay cash or use other plastic surgery financing methods.

When considering a plastic surgery procedure, you must consider how to finance the operation.

For more expensive operations, some people will need to think about loans, but they may only if they have good credit; getting a loan can also be challenging.

Some people have enough cash reserves to finance the operation fully, while others may borrow money from friends or family to pay for their procedure.

“Consumers should be aware that cosmetic surgery is not covered by insurance, so all costs must be paid out of pocket,” says Kevin Kautzman, a certified financial planner in New York City.

Reconstructive surgery focuses on restoring function and normal appearance or correcting deformities.

These surgeries may be covered by medical insurance.

While “plastic surgery” is used broadly, the American Society of Plastic Surgeons recognizes two main subcategories of plastic surgery: reconstructive and cosmetic procedures.

Cosmetic procedures, on the other hand, focus on “reshaping and adjusting normal anatomy” and are not considered medically necessary.

Your health insurance may only cover these procedures if you know how your system will be classified. Plastic surgery has become a popular way to improve appearance, confidence, and self-esteem.

However, these procedures often come with a high cost that not everyone can afford. Fortunately, there are financing options available even for people with bad credit.

This article examines five plastic surgery loans for bad credit in the United States, providing information and guidance on financing your desired procedure.

How to Pay for Plastic & Cosmetic Surgery with Lousy Credit

Most people use credit to pay for all or part of their plastic surgery. Your plastic surgeon’s office can provide financing for plastic surgery to patients.

Not all surgeons or medical institutions offer in-house financing. Instead, they may use a third party to collect payments.

You’ll be happy to hear that there are bad credit options for financing popular plastic surgery procedures. However, you could have a better credit history.

And in that case, you may wonder how to pay for plastic surgery with bad credit. Many patients take advantage of convenient payment plans to finance their cosmetic procedures.

And if you’re looking for financing for plastic surgery, you can consider a personal loan, credit card, or payment plan from your doctor.

During your consultation, our patient coordinator will review your plastic surgery payment plan options and provide you with a quote detailing the cost of your procedure.

While we offer in-house plastic surgery financing through PatientFi, we also accept financing through AlphaOne Credit, CareCredit, MedPlan Credit, MedLoan Finance, and Prosper Healthcare Credit.

In this cost, Dr. Includes Weinmeyer’s surgeon fee, facility fee, anesthesia fee, implant fee, and post-operative apparel fee if applicable.

Your plastic surgeon’s office may have options such as bad credit loans, insurance, medical financing, and payment plans. And with plastic surgery financing, you make monthly payments over time instead of paying for the surgery upfront.

The most commonly used third-party medical funding is Care Credit. Care Credit is a medical credit card. You have to apply for it just like a credit card.

You may need a co-signer on the application for approval if you need better credit. Your choice of words is essential when deciding how to pay for plastic or cosmetic surgery with a bad credit history.

This plastic surgery reconstructs facial and body defects and is often medically necessary. Patients will likely use health insurance and flexible spending accounts to pay for the procedure.

Although people often confuse the two terms, the significant difference can significantly affect your financing options.

And cosmetic surgery can help improve your appearance. Reshapes healthy tissue and is not medically necessary.

Patients must bear the entire cost and often borrow money for the operation. The cost of plastic surgery can be high, and health insurance policies sometimes do not cover most procedures.

However, if you are dissatisfied with your appearance, plastic surgery may be a worthwhile investment. Cosmetic surgery can improve your appearance, confidence, and self-esteem.

It’s understandable to worry about how to pay for plastic surgery. It comes, especially when it’s expensive.

Some of the most common plastic surgery loans with poor credit procedures include:

- A facelift is a rhytidectomy or surgery that reduces loose skin.

- Its average cost is around $8,005 or can vary depending on the location of the treatment.

- Breast implants: Breast implants or augmentations can increase breast size, costing between $6,000 and $12,000, depending on the location of the treatment.

- Liposuction is a surgery that removes excess fat from the skin.

- Its average cost is around $3,600 or can vary depending on the location of the treatment.

- Tummy tucks and abdominoplasty can reduce excess fat and improve body shape.

- The average cost of a tummy tuck is $6,154 or can vary depending on the location of the treatment.

- Nose job A nose job, or rhinoplasty, is surgery to change the shape of the nose.

- Depending on its location, the average cost of rhinoplasty is $5,483.

Relate Article: Salvation Army Free Furniture Voucher

What is a Medical Loan?

A medical loan is a personal loan. Many lenders do not specifically offer medical loan products. However, they will provide personal loans that can be used for almost anything, including paying for various medical expenses.

Because medical debt usually comes with a fixed interest rate, you’ll know exactly how much you owe monthly. Thus, this is an advantage over using a variable-rate credit card to pay medical bills.

Provide. When you take a medical loan, you will receive a lump sum payment that can be used to consolidate or pay off existing medical bills or for upcoming accounts.

Personal loan rates vary widely, so you must compare them carefully to ensure you get the most competitive offer.

The pros and cons of Medical Loans:

Pros:

- Loans are disbursed quickly, sometimes on the same day of loan approval.

- Lenders offer a variety of repayment terms.

- The interest rate is fixed, so this could be a less expensive credit card option.

- Payments are the same every month.

Cons:

- Most lenders have borrowing limits.

- A hard credit inquiry during an application can lower your credit score.

- Interest rates are high, sometimes as high as 35.00% or even higher.

- Fees may apply for this product.

Relate Article: Boost Mobile Ebb Free Phone

Surgery Loans for Bad Credit History

Alternative surgery patients with bad credit have three loan options to finance their operation, depending on whether parts of the procedure are medically necessary to treat disease or injury or to diagnose or treat symptoms.

1. Cosmetic surgery enhances your appearance and doesn’t meet standards.

2. Free plastic surgery is available through health insurance coverage.

- Restores physical function and qualifies as needed.

- Flexible spending accounts cover the remaining expenses.

3. Other alternative processes occupy a vague middle ground.

Surgery Loan for Bad Credit History:

- cosmetic surgery loan

- mid surgical loan

- plastic surgery loan

1. Cosmetic Surgery Loan

- Getting a personal loan sponsored link online to finance cosmetic surgery is easy, even with bad credit. Subprime online lenders specialize in customers with adverse information about their delinquency, charge-offs, repossessions, etc., and can help you overcome two hurdles.

- Patients with low FICO or Vantage scores need better approval from traditional lenders, banks, and credit unions.

It would be best to finance the entire cost as insurance will not cover cosmetic procedures.

Filling out a web-based form exposes your credentials to a vast network of sub-prime lenders competing for your business.

And it’s ready with these elements to increase your chances of approval further.

- Bank routing and account number to facilitate payment.

- Driver license number to verify your identity.

- Employer’s name, address, and phone number.

2. Mid-Surgical Loan

The best way to pay for plastic or cosmetic surgery with bad credit is to have your health insurance cover most of the procedure.

Then, you can take out a loan for the balance using a flexible spending account, which is cheaper than traditional financing.

However, many methods fall into gray areas, and you can save yourself a bundle by writing a letter of medical necessity to your surgeon following these guidelines.

- Breast reduction (mammoplasty): Body mass index BMI less than 35, back or neck pain, or skin fold inflammation or numbness

- Skin removal (panniculectomy): Long-term rash due to weight loss of more than 100 pounds after bariatric surgery

- Nose Surgery (Rhinoplasty): A deviated septum that causes medical disabilities such as sleep apnea, chronic nosebleeds, etc.

- Tummy Tuck (Abdominoplasty): Persistent back pain or incontinence or when combined with another covered procedure.

3. Plastic Surgery Loan

A Flexible Spending Account (FSA) enables ideal lousy credit plastic surgery loans when the procedure is medically necessary.

In this case, you have to finance only the unreimbursed expenses after the payment of the health insurance.

Under IRS rules, your employer must allow all employees to participate in their FSA, no matter how low their credit score.

- Copy

- subtraction

- Billing from out-of-network providers must be balanced.

The best part of an FSA loan is the potential tax savings.

Pre-tax payroll deductions reduce your income reported to the IRS, limiting the amount you pay and FICA taxes.

You can take steps to pay for plastic surgery using an FSA loan.

- Establish the process at the beginning of the FSA planning year.

- Pre-certify from the FSA administrator that they will honor claims.

- Your employer must reimburse eligible expenses immediately.

- We are choosing to maximize contributions during the annual Open Enrollment.

- It takes up to 52 weeks to repay the liability using pre-tax money.

Relate Article: Safelink Free Tablet

Surgery Financing No Credit Check

The ideal elective surgery financing option without a credit check also depends on whether the procedure is medically necessary.

Cosmetic Procedures

Financing cosmetic surgery without a credit check usually means borrowing money from a subprime lender that doesn’t take a copy of your consumer report from Equifax, Experian, or TransUnion and doesn’t look at your FICO or Vantage scores.

A personal loan based on income rather than credit score would be a primary example of how this option works.

These lenders sidestep their most critical risk assessment tools and ignore adverse histories such as delinquencies, charge-offs, repossessions, etc.

Therefore, one can expect higher borrowing costs while lending without a credit check.

- Interest charges

- Credit insurance

- Origination fee

- Penalty on late payment

Brazilian Butt Lift

Brazilian Butt Lift (BBL) payment plans without a credit check are no different than any cosmetic surgery financing options covered in this article.

And they reflect the three essential components to pay for the process.

A BBL repayment plan is another name for a personal loan issued by a lender that doesn’t take a copy of your mainstream consumer report and doesn’t consider traditional scores.

You pay the lender in equal monthly installments.

A BBL payment plan means you must finance the total cost.

Insurance generally does not cover fat transfer procedures performed solely to improve appearance.

BBL payment plans have lower approval rates for patients with poor FICO or Vantage scores (below 550).

Therefore, working through the vast online network of subprime lenders in advance is better than waiting to apply for an in-house loan at a surgeon’s office.

Plastic Surgery

FSA loans are the ideal plastic surgery financing option with no credit check.

The low cost is the best part of this no-credit-check financing option.

Under IRS rules, your employer cannot pull a copy of your consumer report or see your FICO or Vantage scores.

All borrowers have to accept them without hesitation.

Not only are you charged higher origination fees and interest rates, but you also avoid adding credit insurance to your monthly payments.

Plus, you save on taxes because pre-tax payroll contributions report your income to the IRS and your state.

Relate Article: Can You Buy Sushi with EBT

Other Surgery Financing Options

Other Alternative Surgery Financing Options Once again, your choice of words is essential, but a different way is to attract patients with bad credit, but they are only sometimes what they seem.

Industry and consumers often use alternative terms to describe the same concept, as shown here.

Payment Plans

A payment plan for cosmetic or plastic surgery is any financing that allows the patient to pay for the procedure in monthly installments.

And if you need better credit, make sure to let the industry’s name games fool you.

Revolving credit cards set up payment plans with flexible monthly installments that eliminate liability at the end of each billing period, depending on how you pay.

Personal loans enable repayment plans that include fixed monthly installments that satisfy the obligation over a pre-determined period: 12, 24, 36, or 60 months.

Most plastic surgeons still need to set up payment plans. Instead, they may offer you “in-house financing,” referring to a third-party company that offers personal loans or credit cards.

Not Cosigners

Taking out a loan to finance cosmetic surgery with bad credit and no cosigner is a barrier to approval.

And without a qualified cosigner, lenders need something more to accept liability in the event of a future default. Will happen.

It has two strikes against patients who score below 550 and are not cosigners, and they must shine in the remaining areas: employment history and income.

Keep monthly payments low compared to monthly income. Provide the employer’s name, address, and phone for verification.

In-House Financing

If your employer doesn’t offer a flexible spending account, personal loans for plastic surgery often work better than in-house financing for patients with poor credit records and low scores.

When your loan credit is insufficient, you have to act wisely. For this, one should pay attention to these advantages.

Having enough money in the bank allows you to choose a surgeon with the best reputation who offers in-house financing.

Leveraging an extensive network of subprime companies increases your chances of approval compared to what a lender can do with an in-house financing program.

Surgeons who promote in-house financing typically refer patients to third-party companies that handle underwriting and collections for them.

Relate Article: Qlink Compatible Phones at Walmart

Guaranteed Surgery Financing

Depending on whether you are trying to pay for plastic or cosmetic surgery, guarantee financing can have significant implications.

Once again, your choice of words can make a huge difference when you have a bad credit history and a low score.

Down Payment

Be wary of any provider’s advertisement guaranteeing cosmetic surgery financing and read the fine print, if any, before signing on the dotted line.

And no legitimate company can promise to approve patients with bad credit without any strings attached.

Guaranteed offers research like we did, and you’ll find one or more of these flies in the ointment that will give you reason to be skeptical.

- No announcement was made regarding the assurance of his support.

- Promises that apply only to eligible applicants.

- An advance payment of 80% is required.

Pre-Authorization

Guaranteed financing for plastic surgery is possible with pre-authorization from your insurance company—an important step, as these procedures often fall into a gray area, as noted above.

And your plastic surgeon plays a vital role in establishing a medically necessary reason for the course.

Precertification provides written assurance of two essential elements.

- The insurance company will honor the claims.

- The FSA administrator will reimburse the remaining costs.

Your FSA loan eligibility depends on certain payments from the insurance company.

And if the insurer deems the process necessary, the FSA administrator can follow their lead in most cases.

Finance Plastic Surgery With a Bad Credit Loan

Bad credit loans are another option to consider when paying for plastic surgery. Also, consider whether the loan can cover your essential expenses without creating unmanageable debt by looking at the interest rate, loan terms, and repayment period.

Below are some quick cash loan options if you have bad credit:

- Secured Personal Loans: Unlike unsecured personal loans, secured personal loans involve assets as collateral. And instead of focusing on your credit history for that approval, they look at your loan repayment ability and income.

- Medical Loan: Medical loans are unsecured personal loans for medical expenses and elective cosmetic procedures. Unlike most medical or regular credit cards, medical loans are available for various credit histories. Loan amounts range from a few hundred to thousands of dollars, depending on income and loan repayment ability.

- Installment Loans: Personal installment loans work like personal loans but come with fixed repayment terms. Also, this can be weekly, bi-weekly, or monthly.

- Home Equity Loan: A home equity loan is a secured loan that helps homeowners borrow against their home equity. And this is an option for funding.

- Title Loan: A title loan is a secured loan that uses the borrower’s vehicle as collateral. Although no credit score or credit history is required for eligibility, the interest rates on these loans can be high. Additionally, more funding may be needed to cover all costs.

Also, consider improving your bad credit score before taking a bad credit loan.

Most of these loans are online, while others may be available at banks, credit unions, or other financial institutions.

A good credit score can help you get credit approval from more lenders, increased loan amounts, better interest rates, and loan terms.

Relate Article: Free Roof Repair for Seniors

What are Plastic Surgery Loans?

If your health insurance does not cover your plastic surgery procedure, you must pay for your cosmetic surgery regardless of your credit score.

And getting plastic surgery is rare even today. Most people who undergo plastic surgery to enhance their beauty are rich.

However, the main deterrent to undergoing plastic surgery is its cost. That is why people generally do not undergo cosmetic surgery unless necessary.

Therefore, plastic surgery loans are flexible loans with low interest rates that help you pay for the treatment, covering all expenses.

Plastic surgery loans for bad credit are a way to pay for cosmetic procedures, even if you have a bad credit score.

What is Plastic Surgery Financing?

Plastic surgery financing allows you to get the cosmetic procedure you’ve been considering without paying immediately. Club Image works with surgery doctors to finance operations.

Thanks to this special financing deal through Club Image, you can enjoy the benefits of your plastic surgery without the financial burden of paying upfront.

Rather than waiting until a lump sum, the loan lets you get the surgery done immediately and pay in lower monthly installments.

Relate Article: Churches That Help with Motel Vouchers

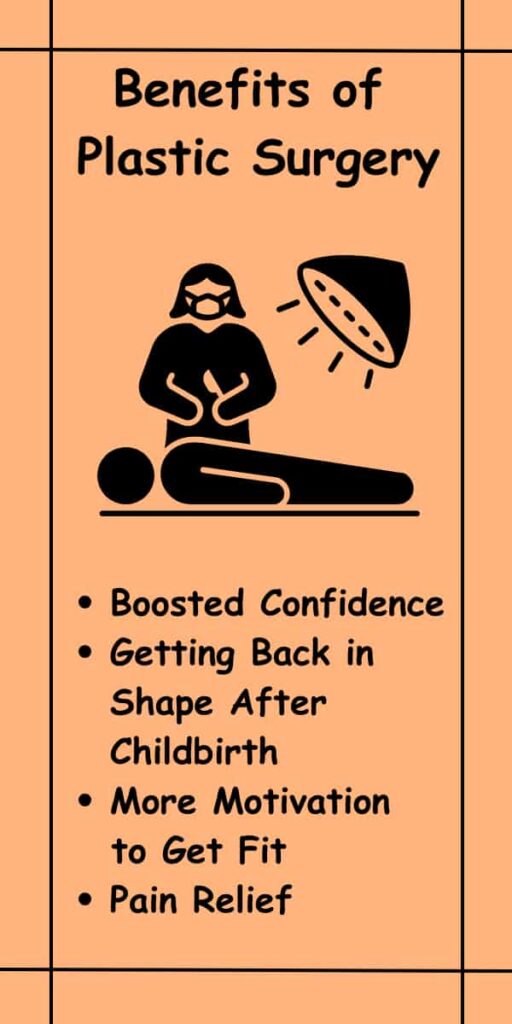

Benefits of Plastic Surgery

- Boosted Confidence: We all know how good wearing a perfectly fitting outfit feels. You can enjoy that feeling when you are as comfortable with your body as in a well-prepared business. You walk a little taller, smile a little easier, and feel at the top of your game.

- Getting Back in Shape After Childbirth: Often, after giving birth and breastfeeding, the body does not return to its pre-pregnancy state. Cosmetic surgeries like breast lift, tummy tuck, and liposuction allow you to reclaim your body. It can help you rediscover yourself and regain your confidence.

- More Motivation to Get Fit: You feel better when you look your best. And when you have a better self-image and higher self-esteem, you go into a cycle of taking better care of yourself.

- Pain Relief: Some cosmetic surgeries can increase mobility and relieve pain caused by undue stress on joints and muscles.

Relate Article: Free Tablet with Medicaid

Assistance With Plastic Surgery

Some finance companies, such as Plastic Surgery Assistance, CareCredit, and Alfion, may allow you to pay over months to years to afford the procedure better.

Alternatively, you can inquire about local plastic surgery training programs for resident clinics to get discounted prices.

The federal government provides low-cost health insurance, such as Medicare, Medicaid, and CHIP. Whether you need medically paid plastic surgery or cosmetic surgery, assistance programs from government and nonprofit organizations can help.

This is a great low-cost option if you need help paying for health insurance.

Federally funded health insurance can provide you the same benefits as private insurance coverage.

Nonprofit organizations can help you pay for plastic surgery for specific procedures and reasons.

Here are some examples for which:

- Medical mission

- Face to face

- My Face

- Smile Train

- Operation Smile

- Mission Plasticos

- My Hope Box

- Face Forward International

- American Society of Plastic Surgeons.

These nonprofit organizations can assist with all types of plastic surgery procedures.

For example, My Hope Chest supports breast augmentation after breast cancer, and the Free to Smile Foundation provides plastic surgery care for children born with congenital disabilities.

The benefits of plastic surgery: The benefits of plastic surgery include getting the procedure done at a private clinic or hospital instead of going through an insurance company, where you may have to wait weeks to see if they want to approve your claim.

If you are going to finance, most plastic surgeons offer it in addition to their standard rates.

Plastic surgery benefits are also provided for people with bad credit for many different procedures, including breast augmentation, nose jobs, lip surgery, tummy tuck, mastectomy, and tummy tuck after weight loss due to illness.

Post-tuck involves breast augmentation with silicone gel implants.

Relate Article: $99 Dentures near Me

What is a Medical Credit Card?

These credit cards only cover medical expenses. Not all medical credit cards are identical, so shop around before applying.

Most of these credit cards have promotions that attract new applicants, such as offering 0% interest for the first few years.

Fees can also vary widely from card to card because they can be used in other ways. They are famous for those worried about spending more on a new card.

They’re also better than using an existing card because they don’t take credit needed for other things. Some of these cards have come under criticism for aggressive lending practices.

0% interest usually applies for the life of the payment plan, between 3 and 36 months. However, if you don’t pay off the balance before that deadline, interest rates kick in, and some companies apply them retroactively.

In other words, instead of paying interest on the balance, you can pay interest on the entire principal balance.

What is a Medical Loan?

A medical loan is an unsecured personal loan used to finance a medical procedure.

Loans are loans taken out for personal reasons, as opposed to mortgages for a home, car loan, or student loan – unsecured, meaning these loans are not secured by collateral.

Thus, these loans come with average interest rates ranging from 5.99% to 27.99%, depending on your credit score.

Interest can be added on loans between $2,000 and $50,000 or more.

Unsecured personal loans are good options for people who don’t want another credit card and can repay the loan in a reasonable amount of time.

Relate Article: How to Get a Free Laptop from Amazon

No Credit Check Cosmetic Surgery Financing

Financing cosmetic surgery without a credit check usually means borrowing money from a subprime lender that doesn’t take a copy of your consumer report from Equifax, Experian, or TransUnion and doesn’t look at your FICO or Vantage scores.

A personal loan based on income rather than credit score would be a prime example of how this option works.

Lenders sidestep their most critical risk assessment tools and ignore adverse histories such as delinquencies, charge-offs, repossessions, etc.

Therefore, expect higher borrowing costs when borrowing without a credit check.

- Origination fee

- Interest charges

- Credit insurance

- Penalty on late payment

Liposuction Payment Plan No Credit Check

Imagen’s Lipo Layaway is a no-interest, prepaid plan that allows you to put $1,000 down and make monthly.

A program designed by specific credit cards used for cosmetic surgery, CareCredit offers special financing with convenient payment options.

Relate Article: Housing Assistance for Single Fathers

No Credit Check Plastic Surgery Financing

Other lenders may have turned you down.

This is for you.

This is an excellent offer that can work for your budget.

Our patients love our practice’s work, and now, with two plastic surgeons, we have more availability than ever.

A new look, a new healthy lifestyle, whatever your goals are, Dr. Janebi can help you achieve. So get started today and find out if you qualify for a loan to achieve the goals you’ve set for yourself: a low down payment and monthly payments for a year. We offer plastic surgery financing with no credit check.

A minimum of $5,000 is required to qualify. We offer many surgical procedures through credit surgery financing. Two great options are our famous mommy makeover body lifts.

To better serve our growing Spanish-speaking patient population, Dr. Agustin Cornejo recently Dr. Joined Janebi. This adds nuance to our approach, eliminates gaps, and ensures they can benefit from our surgical procedures.

Now, if you can’t wait for a new look, no credit check plastic surgery loan is a great option. There are many good reasons not to wait until you’ve saved up for surgery.

Getting to where you want to be now has benefits; This can bring a new beginning within you.

You can finance surgery with bad credit; We have options available.

Although we cannot guarantee financing for plastic surgery, we do our best to make your surgery a reality.

Requirements:

- Checkbook

- Valid driving license

- A credit or debit card is not linked to the same checkbook account.

Bbl Payment Plan No Credit Check

Bbl payment plan no credit check: Brazilian Butt Lift (BBL) payment plans without a credit check are no different than any cosmetic surgery financing options covered in this article.

And they represent the three essential elements to pay for the process. BBL payment plans have lower approval rates for patients with poor FICO or Vantage scores below 550.

Therefore, working through an extensive online network of subprime lenders in advance is a better strategy than waiting to apply for an in-house loan at a surgeon’s office.

A BBL repayment plan is another name for a personal loan issued by a lender that doesn’t take a copy of your mainstream consumer report and doesn’t consider traditional scores.

And you pay the lender in equal monthly installments. A BBL payment plan means you must finance the total cost. And insurance usually doesn’t cover fat transfer procedures to improve appearance.

Relate Article: Wedding Grant

Breast Augmentation Financing No Credit Check

If you are curious about how breast enlargement surgery can enhance your self-image and confidence, now is the best time to implement your ideas.

And you can’t miss the chance to get this life-changing procedure at an affordable monthly price.

Finance Tummy Tuck with Bad Credit

Some of the most common plastic surgery financing with bad credit. And the average cost of a tummy tuck is $6,154 or can vary accordingly.

Sponsored Links Online personal loans to finance cosmetic surgery are easy to get despite bad credit. Subprime lenders that operate.

You can access plastic surgery financing options with bad credit, excellent credit, or anything with United Credit.

Tummy Tuck Finance Bad Credit

Tummy Tuck Finance Poor Credit Tummy Tuck is a form of plastic surgery that removes excess abdominal fat and skin.

Knowing what the procedure will cost and how to finance this expensive cosmetic surgery is essential if you need a tummy tuck.

Cosmetic procedures can help when diet and exercise fail to remove stubborn fat, and they can also help remove excess skin after pregnancy or significant weight loss.

You can have full or partial abdominoplasty. The price depends on whether it is needed or not.

Generally, tummy tucks are not covered by insurance, but coverage depends on the reason for the procedure.

Relate Article: Free Bed Assistance Program 2023

BBL Financing for Bad Credit

BBL Financing for Bad Credit We are on a mission to help you get funding from BBL Loans by simplifying the application and qualification process and finding the right lender.

Be part of the 19.21* million borrowers in the US who qualify for BBL or enjoy your loan for anything else—getting a BBL loan with good or bad credit is challenging.

Tummy Tuck Payment Plan Bad Credit

Tummy Tuck Payment Plan Bad Credit: You can choose an extended payment plan with low APR rates for up to 60 months.

Tummy Tuck Financing for Bad Credit

Tummy Tuck Loans For Bad Credit If you have good or excellent credit, or in some cases fair credit, you have many credit options, such as medical credit cards.

Relate Article: What Gas Stations Accept EBT Cash?

Can You Finance a BBL

The Care Credit credit card is a low-interest way to pay for cosmetic procedures like Brazilian butt lifts quickly.

Because a Brazilian butt lift is not considered medically necessary, the IRS does not allow patients to use FSA/HSA accounts to cover the cost of cosmetic surgery.

As with any cosmetic surgery, it is essential to consult with a highly experienced, board-certified plastic surgeon to determine if you are a good candidate for BBL.

However, many plastic surgeons offer zero-interest patient financing plans that include incentives to pay the total upfront or the option to make manageable monthly payments over a certain period.

What is Brazilian Butt Lift?

The Brazilian Butt Lift (BBL) is a popular buttock augmentation procedure.

It is unique because it creates a more contoured gluteal area with the added benefit of removing unwanted fat from other body parts.

Relate Article: Free Bed for Disabled Person

Tummy Tuck Financing with Poor Credit

Those with average credit often enjoy interest-free options and less money down, and those with poor credit are usually on the positive side.

Sono Bello Financing Bad Credit

Sono Bello financing bad credit Sonoballoon side effects can be more pronounced and long-lasting, including several months of swelling, bruising, incision site scarring, tenderness, contour irregularities, and adverse reactions to tumescent or local anesthesia.

Breast Augmentation Financing Bad Credit

Many women want breast augmentation to get a shapely figure. But paying for breast augmentation can be a challenge.

However, bad credit can hinder seeking a breast implant loan.

Insurance will not cover the cost unless the surgery is performed as a breast reconstruction with a mastectomy.

Related Post:

- Free Tablet

- Dental Implant Grants

- Free Gas Cards

- How to Apply for Free Tablet from Government

- Dental Grants for Low-Income Adults

Frequently Asked Questions (FAQ)

How to Pay for Plastic Surgery with No Credit?

So, how can you raise funds to finance your appointment with the surgeon? The answer is a cosmetic surgery loan — a Personal Loan that you can use to pay for your treatment. Use of funds: The good thing about a Personal Loan is that you can use the funds just as you see fit.

What Credit Score Do You Need for Carecredit?

640 or more

The CareCredit® credit card is a medical credit card that you can use to pay for certain medical procedures, including plastic surgery. To qualify for the CareCredit credit card, you need a credit score of 640 or more, which is in the fair credit score range for FICO®.

What Credit Score Is Needed for Care Credit?

Bottom Line. Care Credit cards require a minimum credit score of 640 or higher to be approved. If your creditworthiness needs some work, consult Credit Sage today to remove inaccuracies from your reports. Allow a team of credit repair specialists to get your credit on track to its optimal potential now.

What Credit Score Do I Need for Care Credit?

To qualify for the CareCredit credit card, you need a credit score of 640 or more, which is in the fair credit score range for FICO®.

Is Carecredit Hard to Get Approved?

Having a credit score of 620 or higher is generally recommended if you want to maximize your chances of approval. However, some applicants have reported being approved with scores as low as 600. It’s worth keeping in mind that if your credit score falls below 600, it may be more difficult to get approved.

What Credit Score Does Care Credit Require?

Is It True That After 7 Years Your Credit Is Clear

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.